Summary

Facebook has bought a 10-per cent stake by investing US$5.7 billion (S$8.11 billion) in the Reliance group-promoted digital business unit, Jio Mart. The investment has served to de-leverage Reliance Industries Ltd’s balance sheet. The new entity has the potential to create a one-stop shop for consumers to access e-commerce, digital payments and social media. However, while it portends to connect clients with their local grocery shops for online transactions, it could create issues of monopoly, data sanctity and net neutrality.

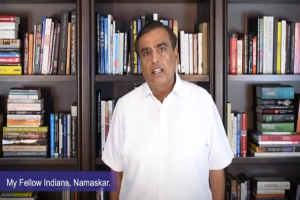

Speaking at its annual general meeting in August 2019, Reliance Industries Ltd’s (RIL) Chairman, Mukesh Ambani, had declared that the Group had prepared a roadmap to become a zero debt company in about 18 months. The Facebook investment of US$5.7 billion (S$8.11 billion) in Reliance Jio platforms will help the company de-leverage its balance sheet. The current net debt for RIL is about ₹1.53 trillion (S$29.9 billion). The other such large deals in the pipeline are Saudi Aramco buying a 20-per cent stake in RIL’s oil to chemical division and a 100-per cent stake sale of Rel-Jio infra to Canadian Brookfield Infrastructure Partners for about US$3.75 billion (S$5.3 billion). The latter two deals are progressing sluggishly due to the oil market downturn and COVID-19 issues.

Through the Facebook deal, RIL seems to have resolved the issue of funding an e-commerce foray, which, by nature, is asset light but capital intensive, thereby getting a great deal of capital infusion to garner consumers. WhatsApp offers an existing customer base of 400 million plus through which e-commerce can be offered. Jio brings to the table 388 million subscribers comprising about 50 per cent of India’s 635 million mobile broadband subscribers. Of the US$5.7 billion (S$8.11 billion) inflow from the deal, US$3.7 billion (S$5.3 billion) will be used to redeem Preference Shares subscribed by RIL. That will help reduce the debt overhang. This will leave RIL with roughly US$2 billion (S$2.84 billion) as capital to spend on the journey to become a one-stop shop for e-commerce, social media, instant messaging and digital payments. A part of this money will also be earmarked for enlisting kirana (grocery) stores, building back-end capabilities and customer acquisition.

Jio Jee Bhar Ke: WhatsApp Your Kirana Store

In an attempt to garner positive optics, the deal is being projected as a new platform that will offer access to the nearest kirana stores – they can provide products and services to their clients’ homes by transacting with Jio Mart using WhatsApp. The deal is being advertised as helping and partnering with small and medium enterprises and about 30 million kirana shops to digitally transact with their clients. By doing this, it hopes to soften adverse reactions from the government and domestic lobbies. The timing of the deal is significant as online platforms selling essential goods have suddenly witnessed a surge in demand. It is reported that before the COVID-19 lockdown in the country, just about one per cent of the ₹80,000 crore (S$15.7 billion) grocery market was represented by online players. Big Basket, the largest online grocery store, said that after the lockdown, about 50 per cent of the market is being accessed by online platforms.

The model, in a broad manner, competes with Amazon-Future Group’s Big Bazaar partnership. However, RIL’s ambition is far greater. WhatsApp/Reliance Jio App in India has the potential to become a ‘super’ app viz the ‘WeChat’ equivalent of China, which will be used to garner consumers, enlist kirana stores as well as use Jio Money to complete the transaction. It is planned that kirana stores will put their inventory online and a user of WhatsApp/Reliance Jio will be able to order goods online, being supplied by the kirana store, or through a delivery unit of this venture. The deal will also help Facebook navigate Indian regulatory hurdles. It had made one attempt when it tied up with Anil Ambani’s now defunct RCom business which had got mired in net neutrality issues as the Telecom Regulatory Authority of India disallowed Facebook’s Free Basics platform.

RIL has always supported the government’s data localisation policies. So, RIL and Facebook may find themselves differing on key issues on how data is collected, stored and shared in India. The government on the other hand, has been wary of large foreign technology companies and their contrary positions on key issues, particularly related to data storage and protection. There would also be concerns about the sanctity of the vast amounts of data the entity would garner about its clients, considering it is an end-to-end engagement. The Competition Commission may also worry that the combined entity could become monopolistic and not give clients an alternate digital platform to carry out digital transactions.

However, on the macro side, this deal further shores up India’s external account in some sense. It could be a rare year, where India runs a zero current account deficit. If India can manage additional foreign direct investment inflows, its reliance on speculative dollar capital will become significantly lower in what is otherwise a very challenging year for emerging markets.

On the political spectrum, the Swadeshi Jagran Manch, a Rashtriya Swayamsevak Sangh (RSS) affiliate, has raised concerns about privacy and net neutrality. It feels the deal, poses a bigger threat to local interests than American technology giant Amazon and Flipkart, which majority-owned by the American retail major Walmart. Concerns have also been echoed by the Confederation of All India Traders, the largest body representing retail traders and Laghu Udyog Bharati, another RSS affiliate. Other political outfits have not openly emerged with their opinions as yet.

The Reliance Jio-Facebook Deal:

Creating a One-stop Shop for Consumers

. . . . .

Mr Vinod Rai is a Distinguished Visiting Research Fellow at the Institute of South Asian Studies (ISAS), an autonomous research institute at the National University of Singapore (NUS). He is a former Comptroller and Auditor General of India. He can be contacted at isasvr@nus.edu.sg. The author bears full responsibility for the facts cited and opinions expressed in this paper.

-

More From :

More From :

-

Tags :

Tags :

-

Download PDF

Download PDF