Taiwan: A Potential Economic Partner for South Asia

Mohammad Masudur Rahman

3 December 2020Summary

Taiwan is a major hub of the global supply chains and one of the leading investors not only in China, but also in the Southeast Asian markets. Although complementary, bilateral trade between South Asia and Taiwan is only about US$9 billion (S$12 billion), while investment has only picked up recently. The computable general equilibrium analysis indicates a substantial economic benefit of bilateral tariff elimination between Taiwan and its South Asian partners. Taiwan has a substantial comparative advantage in producing hightechnology manufacturing goods while South Asia’s main strength is in the resource-based agricultural and light manufacturing sectors. Taiwan has been maintaining a liberalised trade regime with minimal import tariffs and non-tariff measures for decades. As South Asia is booming and Taiwan is seeking alternative markets and investment opportunities, it is time to deepen this bilateral economic relationship. South Asia, a market of 1.5 billion people with an emerging middle class and cheap labour, is an ideal place for investment. A comprehensive economic partnership with a preferential trade and investment agreement would be useful to attract Taiwanese multinationals and for seamless trade between South Asia and Taiwan.

Taiwan Investment from West to South

Taiwan, which was among the four ‘Little Dragons’, together with Singapore, Hong Kong and South Korea in the 1980s, has now emerged as a hub of global supply chains and production networks of electronics, computers and communication technologies. Being a small island country with a population of 23.7 million, it is highly integrated into the global economy and heavily dependent on global trade for its economic growth. Taiwan’s total trade in goods and services increased from US$430 billion (S$577 billion) in 2005 to US$713 billion (S$956.78 billion) in 2018, and trade in the country’s gross domestic product (GDP) was 123 per cent in 2018, reflecting enhanced importance of foreign trade in the economy (UNCTAD, 2020). The outward foreign direct investment (FDI) stock of Taiwan was US$100 billion (S$134.2 billion) in 2005, which reached US$360 billion (S$483.1 billion) in 2019 (UNCTAD, 2020).

The production networks, established by Taiwanese manufacturing companies in China and Southeast Asia, have had enormous impact on employment generation and economic growth in Asia. In the 1990s, more than 2,000 Taiwanese electronics firms invested in Penang, Malaysia, which helped to establish one of the most important electronics clusters in Southeast Asia (Kristy, 2016). Taiwanese firms have contributed significantly to private sector development in China and are often considered as important contributors to China’s industrial revolution in the 1990s, especially in the eastern coastal areas of Zhejiang, Guangdong and Fujian.

In the late 1980s, some Taiwanese companies turned to Vietnam when the socialist country first opened its doors to foreign investors. Since 1986, Taiwan has remained a top foreign investor in Vietnam when the government adopted the “Doi Moi” or the market economic reform policy. As of September 2019, Taiwan’s accumulated FDI volume in Vietnam reached US$32.4 billion (S$43.5 billion), becoming the fourth largest FDI source in the country (Bureau of Foreign Trade [BFT], Ministry of Economic Affairs [MEA], Taiwan, 2020). Following aggressive investments in Vietnam, Taiwanese companies have been seeking every opportunity to invest in other lesser-developed Asian countries.

Box 1: Free Trade Zones – Taiwan’s Manufacturing Clusters

Taiwan’s industrialisation started earlier than most other developing countries in Asia. Since the 1960s, the Taiwanese government actively promoted rapid industrialisation and managed to transform its economy by moving its labour force from the informal sector to organised manufacturing industry. Rapid industrialisation and growing competitiveness allowed Taiwan to pursue an export-led growth by taking advantage of the growing global market of the 1970s and 1980s. Taiwan’s manufacturing exports currently account for about 90 per cent of its total exports (BFT, 2020). It is highly competitive in electronics, information and communication products, metals, machinery and plastics and chemicals.

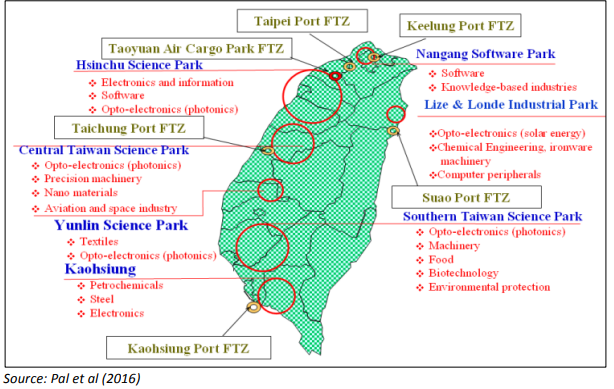

Taiwan has been actively developing to promote the establishment of Free Trade Zone (FTZ) clusters, with the aim of leveraging its advantageous geographic location within the Asia-Pacific region (Figure 1). The FTZs serve as an important role for comprehensive cluster development and create an excellent environment for business by reducing trade barriers.

Figure 1: FTZs or Industrial Clusters in Taiwan

Due to substantial investments in the last two decades in China and Southeast Asia, Taiwanese companies have managed to establish sector-specific production networks and supply chains in the region. Taiwan produces more than 80 per cent of the world’s notebook computers and their peripherals, but most of the production is not based in Taiwan (Kristy, 2016). Some parts are made by factories in Guangdong province, China, while others are made in different East Asian countries. However, the research and development departments are maintained in the headquarters in Taiwan. With operations in different countries, Taiwan is a de facto partner participating and investing heavily in the regional economy.

Sustainable Trade Index

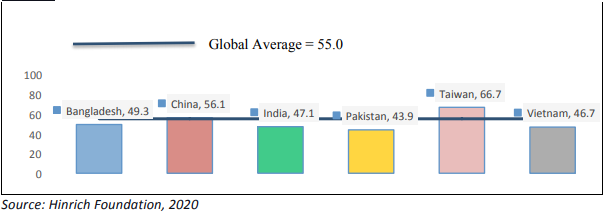

Hinrich Foundation, in association with the Economist Intelligence Unit, has developed a sustainable trade index (STI) considering three aspects of sustainability: economic, environmental and social factors. While Taiwan’s STI is much higher compared to China and other East Asian economies, Bangladesh’s index is higher compared to all South Asian countries, even better than Vietnam. India’s STI is the same as Vietnam. Figure 2 shows a comparative STI index of South Asian economies and its main partner including Vietnam and China. This indicates that sustainable trade in South Asia is very stable, which is suitable for long term investment.

Figure 2: Sustainable Trade Index

Taiwan’s Trade with South Asia

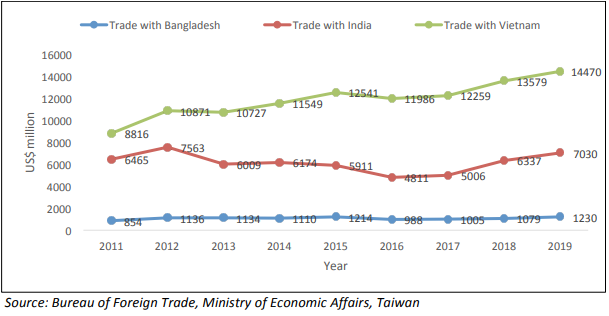

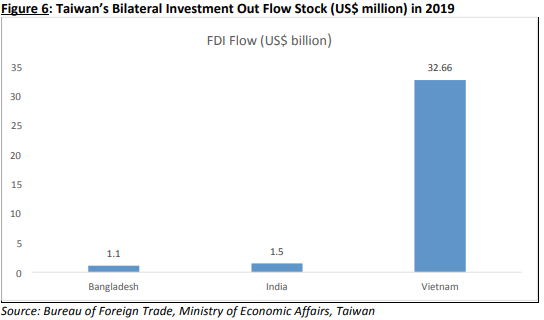

Although Taiwan has made tremendous progress in trade and investment in East Asia, trading with South Asia is relatively low. Taiwan’s total trade with South Asia was about US$9 billion (S$12 billion) in 2019. India is Taiwan’s leading trading partner in the region, constituting about US$7 billion (S$9.4 billion) in 2019, while Bangladesh is its second largest trading partner in South Asia, accounting for about US$1.2 billion (S$1.6 billion) in 2019. Taiwan’s trade with the rest of South Asia is only US$1 billion (S$1.3 billion). Trading with South Asia is much lower compared to its East Asian partners. Taiwan’s main trading partners are China, Hong Kong, the United States (US), the European Union and East Asia. Taiwan has also been among the top foreign investors in China and Southeast Asia but limited in its investments in South Asia. Taiwan’s investment in Vietnam was US$32.6 billion (S$43.7 billion) whereas the investment in India was only US$1.5 billion (S$2 billion) and about US$1 billion (S$1.3 billion) in Bangladesh in 2019 (BFT and Bangladesh Bank, 2020).

Figure 3 shows that Taiwan’s trade with India was US$6.4 billion (S$8.6 billion) in 2011 which increased to only US$7 billion (S$9.4 billion) in 2019. On the other, during the same period, Taiwan’s trade with Vietnam increased from US$8.8 billion (S$11.8 billion) to US$14.5 billion (S$19.4 billion). Taiwan’s trade with the other South Asian countries increased slightly over the period. Bangladesh’s average trade with Taiwan was about US$1 billion (S$1.3 billion) over the last decade.

Figure 3: Taiwan’s Trade Trend with South Asia and Vietnam

Trade Complementarities between South Asia and Taiwan

There is high trade complementarity between South Asia and Taiwan. Taiwan has a comparative advantage in producing high-technology manufacturing goods. In contrast, the main strength of South Asia lies in resource-based products, especially agricultural and light manufacturing, including textiles and clothing industry. However, the extent of bilateral trade is currently low, but that does not mean there is no potential. Taiwan’s traditional competitors, such as China and South Korea, have much better market penetration in all the South Asian countries. The low market share of Taiwan may be merely a manifestation of its mode of production. Taiwanese firms have plants across East Asia and most of the final products are shipped from these foreign locales. Therefore, bilateral trade data may underrepresent Taiwan’s actual market share in the region. On the other hand, the types of products South Asia can export to Taiwan are low valueadded goods that tend to have very high price elasticity. Therefore, other suppliers could easily export these products at a lower cost to Taiwan. In addition, lower trade between South Asia and Taiwan may be due to the high trade barriers among these countries. If so, a comprehensive preferential trade and investment agreement may help to increase bilateral trade.

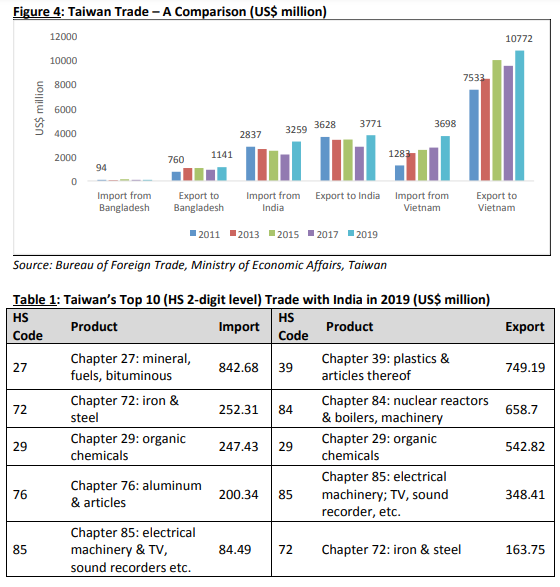

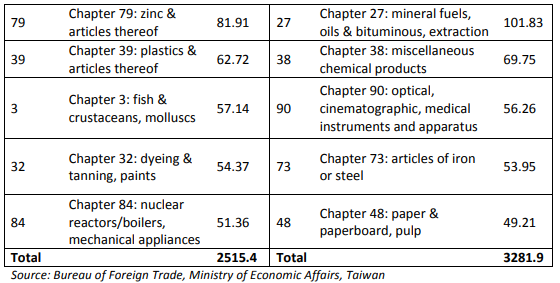

Bilateral Trade between India and Taiwan

The trade volumes between India and Taiwan have increased from US$6.4 billion (S$8.6 billion) in 2011 to US$7.1 billion (S$9.5 billion) in 2019. This increase is not substantial (Figure 4). India’s exports to Taiwan amounted to US$2.5 billion (S$3.3 billion) in 2019, consisting primarily of mineral and fuels, iron and steel, organic chemicals etc. While Taiwan’s exports to India rose to US$3.2 billion (S$4.3 billion), it consisted mainly of plastics, nuclear reactors, boilers, machinery and mechanical appliances, chemicals and electrical machinery. It is important to note that the trade balance between the two countries has been well-balanced over the decades. As India is Taiwan’s 17th largest trading partner and 14th largest export destination, it is an essential partner under Taiwan’s new southbound policy. Table 1 shows bilateral trade structure at the Harmonised System (HS) two-digit level between India and Taiwan.

https://cuswebo.trade.gov.tw/FSCE020F/FSCE020F

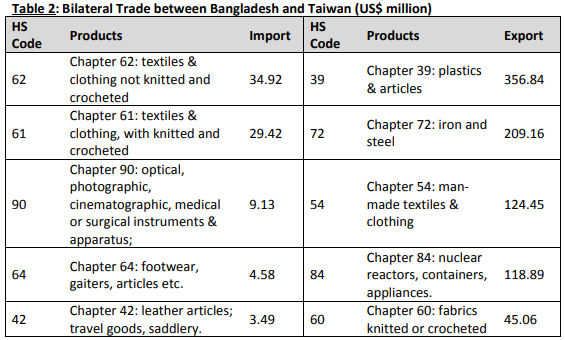

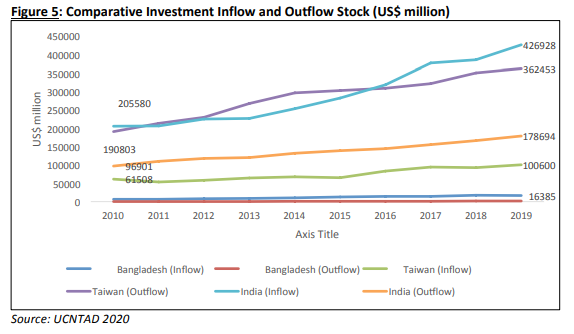

Bilateral Trade between Bangladesh and Taiwan

Bangladesh is Taiwan’s second-largest trading partner in South Asia with exports from the latter standing at US$1.1 billion (S$1.5 billion) in 2019. Table 2 shows Taiwan’s top 10 products at the HS 2-digit level. Taiwan’s main exports items to Bangladesh are manufacturing goods, both light and heavy manufacturing items including plastics items, iron, steel, nuclear boilers etc. In contrast, Bangladesh’s export to Taiwan is less than US$100 million (S$134 million) and mostly are traditional readymade garments products.

https://cuswebo.trade.gov.tw/FSCE020F/FSCE020F

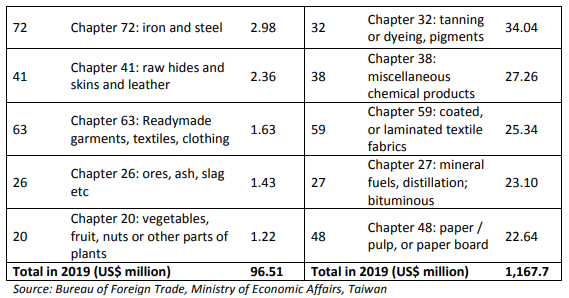

Taiwan’s Investment in South Asia

Figure 4 shows that India and Bangladesh are key FDI recipient countries in South Asia. India’s FDI inflow stock increased from US$205 billion (S$275.2 billion) in 2010 to US$426 billion (S$572 billion) in 2019 whereas Taiwan has been emerged as an outward-looking economy where FDI outflow stock rose to US$362 billion (S$486 billion) in 2019 from US$190 billion (S$225.1 billion) in 2010. However, the South Asian countries have been unable to attract Taiwan’s huge investment. Figure 5 shows a comparative scenario of Taiwan’s investment in Bangladesh, India and Vietnam.

Bilateral Investment between India and Taiwan

Figure 6 shows that Taiwan’s investment in India was only US$1.5 billion (S$2 billion) in 2019. However, this estimation does not include the recently announced US$5 billion (S$6.7 billion) project by Taiwan’s manufacturing giant Foxconn in India. According to statistics from the BFT, currently, there are about 105 large- and medium-sized Taiwanese companies investing in India. The main sectors for investment include smartphones, electronics, auto parts, textiles and machinery.

According to the BFT, the total investment by these companies was US$1.5 billion (S$2 billion) in 2019, while India’s investments in Taiwan was merely US$6.6 million (S$8.9 million) in 2019. Recently, a large Taiwanese company, Century Development Corporation, had its groundbreaking ceremony in Bengaluru to establish a Technology Innovation Park. As India has become a new manufacturing base for electronic parts supply chains, Taiwanese companies such as Wistron and Foxconn corporation will play important role to boost the ‘Make in India’ policy.

https://cuswebo.trade.gov.tw/FSCE020F/FSCE020F

Bilateral Investment between Bangladesh and Taiwan

Bangladesh received about US$2.3 billion (S$3.1 billion) net FDI inflow in the 2019 fiscal year (Bangladesh Bank 2020). The top five investors were the United Kingdom, the US, United Arab Emirates, Singapore and Norway. Taiwan’s total FDI inflow stock in Bangladesh was about US$1.1 billion (S$1.5 billion) during the year. In 2019, Taiwan invested about US$46 million (S$61.8 million) in which about US$22 million (S$29.5 million) was in leather and leather products. It has also invested in textiles, chemical, pharmaceutical sectors and trading service sector.

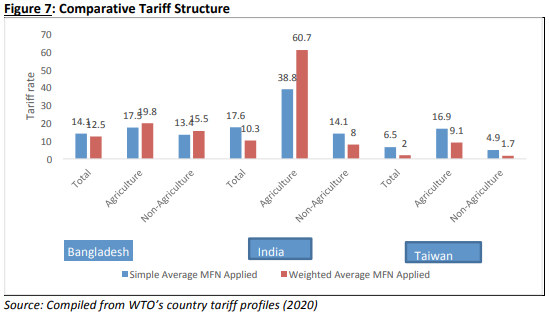

Barriers to Trade

Figure 7 demonstrates a comparative tariff structure of Bangladesh, India and Taiwan. Taiwan’s average applied tariff rate has been reduced substantially. Taiwan’s weighted average applied most-favoured nation (MFN) tariff rate was about two per cent in 2019. Taiwan’s applied tariff for least developed countries was about one per cent (UNCTAD 2020). However, Taiwan’s applied MFN tariff rate on the textiles and clothing sector was about 11 per cent in 2019 – it was one of the major export items for all South Asian countries.

The Indian agricultural sector is highly protected, and weighted average MFN tariff is about 60 per cent whereas Bangladesh’s weighted average applied tariff rate is about 12 per cent. The South Asian tariff rates are still very high compared to the East Asian countries. Appendix 1 shows the MFN applied tariff structure of Bangladesh, India and Taiwan at the HS two-digit level. Indian MFN applied tariff at HS six-digit level is about 20 per cent while Bangladesh’s import tariff is about 15.5 per cent.

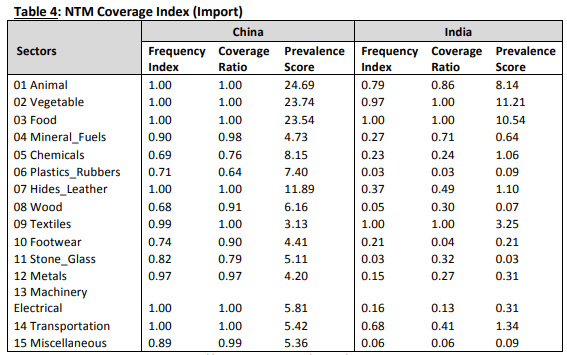

Table 4 shows a sector-wide non-tariff measures (NTM) index of China and India. These are important in understanding the nature and extent of various measures that they are imposing on their imports. The frequency index indicates the percentage of products affected by one or more NTM. The coverage ratio is the share of trade subjective to NTMs for a country where prevalence counts how many non-tariff measures apply to a given product or a group of products.

Table 4 also demonstrates that both the frequency index and coverage ratio are very high, which is close to that of Chinese imports, which means China imposes NTM on almost each of their imported product. China imposes several NTMs on its agricultural imports.

Compared to China, India sets a lower number of NTMs on all of their imported products, from agriculture to plastics materials. Although India’s tariff measures are much higher, NTMs seems lower compared to Chinese NTMs.

Taiwan’s NTM regime is much lower compared to India or the other South Asian economies. Taiwan has imposed only one NTM on steel imported from India. Appendix 2 shows the sector-wide bilateral non-tariff measures imposed by India on Taiwan. India has imposed about 231 NTMs on imports from Taiwan where Taiwan has imposed only one NTM on imports from India. Taiwan has one of the lowest barriers to trade where both tariff and NTMs are very low. South Asia should take advantage of Taiwan’s market access facilities.

Source: UNCTAD i-tip (2020), https://trains.unctad.org/forms/Analysis.aspx

The GTAP Model for Macroeconomic Analysis1

The computable general equilibrium (CGE) modelling framework of the Global Trade Analysis Project (GTAP) is the most comprehensive common modelling technique to estimate the macroeconomic economic impact of a trade agreement. The detailed structure of the GTAP database – its assumptions, model, equations, closures, elasticity and parameters – presented in Hertel (1997). Gilbert et al., (2018), provides a detailed systematic literature review of the CGE and discusses the strengths and limitations of the CGE model in international trade. The GTAP framework structure includes regional households, governments, different sectors and their nests as well as global sectors across countries and how they are linked to each other.

In this paper, we use version 10 of the GTAP model and dataset to explore the impact of tariff elimination between Taiwan and Bangladesh as well as between India and Taiwan. The Version 10 of the GTAP database covers 65 sectors, 141 countries and eight factors of production. For the sake of convenience, the 141 regions have been aggregated into three regions whereas the 65 sectors have been aggregated into 10 sectors.

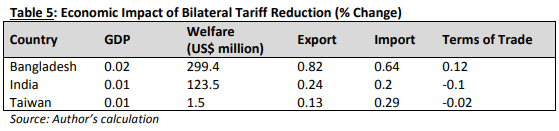

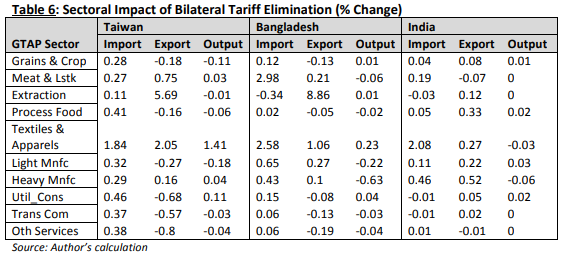

The welfare and other macroeconomic effects of the simulations are presented in Table 5. Detailed sectoral exports, imports and output are shown in Table 6. The results show that if these countries eliminate tariffs bilaterally, all three countries are expected to gain in welfare, real GDP, exports and imports. The real GDP of Bangladesh, India and Taiwan could be increased by 0.02, 0.01 and 0.01 per cent respectively. The allocative efficiency could increase, which will then lead to higher output and production. The simulations show that real exports of Bangladesh, India and Taiwan may increase by 0.82, 0.24 and 0.13 per cent respectively, whereas the imports may increase by 0.64, 0.20 and 0.29 per cent respectively.

Conclusion

Taiwan, a little dragon, is a hub of global supply chains and production networks of electronics, computers and communication technologies and deeply integrated into the global economy. The country has maintained a liberalised trade regime with lower tariffs and non-tariff measures. Its average MFN applied tariff is about two per cent, and is one of the least NTM-imposing countries in the world.

Although trade complementarity between South Asia and Taiwan is very high, bilateral trade is only about US$9 billion (S$12 billion) and investment has increased only recently. The CGE results illustrate that bilateral tariff eliminations between Bangladesh and Taiwan as well as between India and Taiwan show a positive economic gain in terms of welfare, real GDP, exports and imports. The exports of Bangladesh, India and Taiwan may increase by 0.82, 0.24 and 0.13 per cent respectively.

Taiwan has a substantial comparative advantage in producing high technology manufacturing goods while South Asia’s main strength is in the resource-based agricultural and light manufacturing industry. Taiwan has a lot to offer to South Asia and vice versa. Taiwan’s next investment destination could be South Asia. As South Asia is showing potential, and Taiwan is seeking alternative markets and investments opportunities, it is time to deepen its bilateral economic relationship. With a market of 1.5 billion people and an emerging middle class, and a substantially cheaper labour force, South Asia is an ideal place for investment. However, for most of the South Asian countries, both tariffs and NTMs are comparatively higher than those in Taiwan. However, a comprehensive economic partnership with a preferential trade and investment agreement would be useful to attract Taiwanese investment and have seamless trade with Taipei.

. . . . .

Dr Mohammad Masudur Rahman is a Visiting Research Fellow at the Institute of South Asian Studies (ISAS), an autonomous research institute at the National University of Singapore (NUS). He can be contacted at masudrahman@nus.edu.sg. The author bears full responsibility for the facts cited and opinions expressed in this paper.

Photo credit: Wikimedia Commons

-

More From :

More From :

-

Tags :

Tags :

-

Download PDF

Download PDF