Summary

In the 2012-13 budget, the Indian government introduced an amendment to the Income Tax Act to enable it to tax retrospectively. This amendment set of a spate of litigations filed, among others, by Vodafone and Cairn Energy. The permanent court of arbitration at The Hague ruled in favour of the companies. This verdict has led to the Indian government taking a positive step to introduce an amendment to the erstwhile Act to withdraw the retrospective tax levied subject to certain caveats. This has been hailed as a welcome step.

In 2007, Vodafone acquired a controlling stake in Indian telecommunication company, Hutchison Essar, for US$11.2 billion (S$15.2 billion). Though the deal was executed in Cayman Islands, the Indian government believed that Vodafone was liable to pay capital gains tax on the deal as it involved the transfer of assets located in the country. So, in 2009, it raised a demand under the Income Tax Act on Vodafone for failing to deduct tax at source from the amount it paid to Hutchison. Vodafone contested the demand on the ground that that the company transferred was an overseas one and not an asset in India. The government, however, felt that even though no asset in India was transferred, the law provided for a tax liability accruing on the gains from the transaction. By this interpretation, Vodafone incurred a tax liability of about ₹22,000 crore (S$4.1 billion). This was challenged by Vodafone in the Supreme Court. The Apex Court held that the extant law did not mandate the levy of tax on such a transaction. The Indian government did not accept the verdict and introduced a retrospective amendment to the Income Tax Act in the Budget of 2012-13 to provide for liability of tax even on the transfer of stakes of an overseas company which derived substantial value from its assets in India. While the amendment to the Act was aimed at penalising Vodafone, 17 other companies also fell into the retrospective tax liability net.

In another offshore transaction, United Kingdom’s Cairn Energy reorganised its Indian oil and gas exploration business prior to an initial public offering. It went on to sell part of its stake to Petronas of Malaysia and then on to the Indian Vedanta group in the 2009-11 period. Post the 2012 amendment, the Income Tax department raised a liability of ₹10,247 crore (S$2 billion) on Cairn Energy for its reorganisation and recovered around ₹8,000 crore (S$1.77 billion) by selling the shares of Cairn India.

In 2014, both companies filed for arbitration in the permanent court for arbitration at The Hague under the India-Netherlands bilateral investment promotion and protection agreement. In both cases, the verdict went in favour of the companies. While no damage was levied on the government in the Vodafone case, in the Cairn Energy case, it was directed to pay US$1.4 billion (S$1.9 billion) to the company in damages. The Hague arbitrations court’s verdict made policymakers seriously reconsider the advisability of retaining the 2012 law. The Indian government had to recognise that there was neither any other possibility for it to evade the verdict nor was there wisdom in trying to do so. Meanwhile, Cairn Energy moved various courts in different jurisdictions to seize Indian assets to recover the amount. A French court allowed Cairn Energy to seize the Indian government’s assets in France. That was the tipping point. India was being adversely judged for its unfriendly stand towards foreign investments. It was on these considerations that a policy decision was taken to amend the provision introduced in 2012.

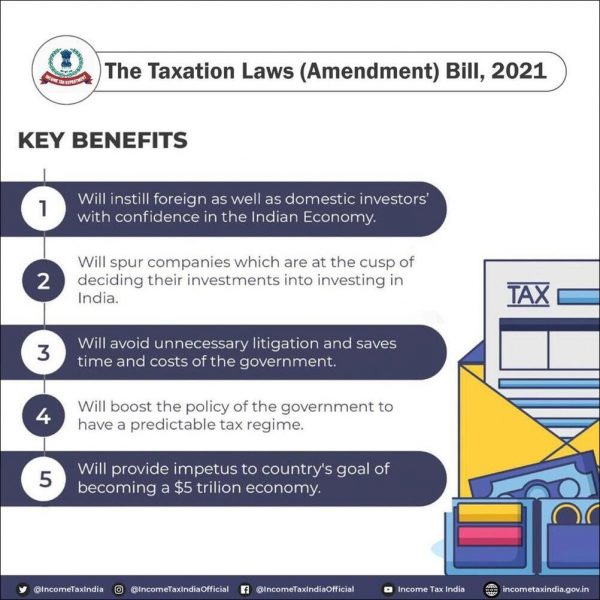

On 5 August 2021, the government introduced a Bill in the Lok Sabha to amend the provisions of the Income Tax Act, 1961, as amended by the Finance Act 2012 which had been introduced to nullify the decision of the Supreme Court in the Vodafone case. In a significant admission of the reality of the situation that the amendment had created, in the ‘object’ statement appended to the 2021 Bill, the government has averred that the tax demand arising out of the retrospective tax policy “continues to be a sore point with potential investors” whereas “quick recovery of the economy after the COVID-19 pandemic is the need of the hour and foreign investment has an important role to play in promoting faster economic growth and employment.”

In retracting from that position, the 2021 Bill proposes:

(a) no tax demand shall be raised in future on the basis of the said retrospective amendment;

(b) nullify the demand in pending cases; and

(c) refund the tax already collected.

The Bill, as passed by both Houses of the Parliament, does not seek to withdraw the 2012 amendment but has hardwired into it a framework to resolve international arbitration cases that the government has lost subject to certain conditions. On its part, the government will withdraw all tax demands that have been levied retrospectively subject to the taxpayers waiving their rights to seek any legal remedy in future. The government will refund the tax collected without any interest. The government’s action in not withdrawing the 2012 amendment appears to ensure that the taxed entity does not continue to litigate and seek various other legal remedies. So, the objective is to merely reverse the tax demand and, where the amount has been collected, refund the same. Rules enabling the provisions in the Act and procedures will soon be prescribed by the government.

This action of the government was long overdue. Delay had entertained doubts in the minds of prospective investors due to lack of investor protection. The enactment will exorcise these apprehensions and boost investor sentiment. It will show the government’s intent to undo a provision which was acting as a disincentive to foreign investors. The action will give a boost to foreign direct investment such that fence sitters planning to invest in the Gujarat International Finance Tec-City and such other ventures will be encouraged to invest. It will provide investors a stable and predictable tax regime.

. . . . .

Mr Vinod Rai is a Distinguished Visiting Research Fellow at the Institute of South Asian Studies (ISAS), an autonomous research institute at the National University of Singapore (NUS). He is a former Comptroller and Auditor General of India. He can be contacted at isasvr@nus.edu.sg. The author bears full responsibility for the facts cited and opinions expressed in this paper.

Photo credit: Twitter\Income Tax India’s official

-

More From :

More From :

-

Tags :

Tags :

-

Download PDF

Download PDF