Summary

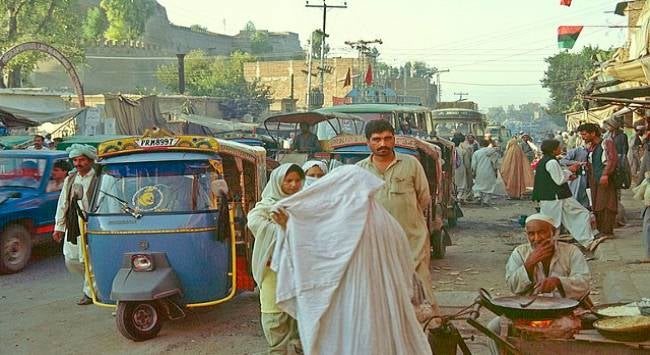

Pakistan is currently facing soaring inflation rates, depleting foreign currency reserves and the all-too-real possibility of default. How the country navigates the crisis remains to be seen as an option to steer through the troubles that come with mounting political risks and consequences. Pakistan needs to shift its focus from short-term resolutions to sustainable changes in the long run and craft a more comprehensive strategy to mitigate its current, difficult and seemingly intractable situation. However, this is challenging in the face of an enduring political crisis. As the crisis prolongs, the heaviest price, in the end, is paid by ordinary Pakistanis as they struggle to make ends meet.

Pakistan is facing significant economic challenges with high inflation, a balance of payment crisis, a growing burden of debt and low economic growth. The country has struggled to meet its financial obligations and prevent a downward economic spiral. Pakistan’s foreign exchange reserves have shrunk by more than half in the past year, to just over US$9 billion (S$12 billion) – about six weeks of imports. The Pakistan rupee (PKR) has 24 per cent of its value against the American dollar in 2022, the country’s external debt has risen by 38 per cent to PKR20.69 trillion (S$98.5 million), inflation has surged to 31.5 per cent (its highest level since 1974) and the current rate of economic growth stands at a meagre 1.7 per cent. These developments have raised significant concerns and global rating agency, Moody’s, which recently cut Pakistan’s sovereign credit ratings to its lowest point in three decades, noted concerns for the country’s liquidity, high risk of default and prospects for recovery.

While the current economic crisis can be traced to various internal factors, including poor management of the economy, political instability and corruption, external factors, such as the global economic slowdown and the COVID-19 pandemic, have significantly impacted Pakistan’s economy. The pandemic has led to a decline in global trade, lower foreign investment and a decline in remittances. Pakistan, which relies heavily on exports and remittances, has struggled to mitigate its balance of payment crisis and decline in foreign reserves. The impact of the war in Ukraine compounded supply chain issues and spikes in energy prices. The devastating monsoonal floods ravaged parts of the country, adding to the cost of damages and economic losses of over US$30 billion (S$40.2 billion).

The agreement with the International Monetary Fund (IMF) in 2019 for a US$1.1 billion (S$1.47 billion) bail-out programme was initially suspended, due to a lack of progress on promised reforms. These planned reforms comprised actions needed to strengthen tax revenue mobilization, including the elimination of tax exemptions and loopholes, and prudent expenditure policies. Prime Minister Shehbaz Sharif, though reluctant to concede to the strict demands of the IMF, has recently loosened restrictions on Pakistan’s currency and has increased electricity prices, alongside significant increases in taxation. Moreover, the State Bank of Pakistan has raised interest rates to 20 per cent (the highest since 1996) to meet IMF conditions as well as to curb inflation. The price of food, beverage and transportation has surged by more than 45 per cent in the country. Despite Washington’s encouragement towards Pakistan’s engagement with the IMF, Pakistan remains open to diversifying its options. Recently, the Industrial and Commercial Bank of China approved a rollover of a US$1.3 billion (S$1.75 billion) loan for Pakistan, which will help shore up the country’s depleting foreign exchange reserves. While Pakistan is of high importance to the Chinese, assistance will undoubtedly have strings attached. Precisely what those might be, remain uncertain.

Because Pakistan has faced a repeated balance of payment crises and has struggled to pay off its loans, economic expert, Brad Setser, has maintained that Pakistan must negotiate a “serious reprofiling“ of its payments. But this requires significant and substantive internal reforms and restructuring something has noted that the country has been historically unwilling to undertake and learn from the mistakes of the past. According to political analyst Madiha Afzal, Pakistan needs to significantly restructure its economy. “The clear underlying malaise of the economy”, she maintains, is “the fact that something fundamentally will need to change, in terms of how much the economy produces versus how much it spends, to avoid default down the road.”

Moreover, Pakistan needs to shift its focus from short-term resolutions to sustainable changes in the long run and craft a more comprehensive strategy to mitigate its current, difficult and seemingly intractable situation. The imperative to do so is perhaps now more than ever since past narratives about leading powers coming to rescue the state from default because Pakistan is either too important or too dangerous to fail appears to be losing traction. However, with hard choices ahead, finding political resolve amidst the turmoil and uncertainty means that implementing economic reforms comes with increasing political risks and possible electoral backlash as Sharif’s rival, former prime minister, Imran Khan, grows in popularity. Indeed, the pursuance of reforms that have raised the cost of living for everyday Pakistanis has adversely impacted Sharif’s standing as prime minister. Hard choices lie ahead for the country as the future looks increasingly uncertain.

. . . . .

Ms Kunthavi Kalachelvam is a Research Analyst at the Institute of South Asian Studies (ISAS), an autonomous research institute at the National University of Singapore (NUS). She can be contacted at kk.isas@nus.edu.sg. Dr Imran Ahmed is a Research Fellow at the same institute. He can be contacted at iahmed@nus.edu.sg. The authors bear full responsibility for the facts cited and opinions expressed in this paper.

Pic Credit: Wikipedia commons

-

More From :

More From :

-

Tags :

Tags :

-

Download PDF

Download PDF