Summary

India’s latest gross domestic product (GDP) numbers shrunk by 23.9 per cent, reflecting a huge contraction in the domestic services industries following the imposition of a country-wide lockdown to tackle the COVID-19 pandemic. These industries, contributing to more than 60 per cent of the GDP, are unlikely to recover soon, given the prolongation of COVID-19. While the later quarters might experience weak positive growth as more activities resume, FY2020-21 should experience overall negative growth and go down as one of the worst years in India’s modern economic history.

India’s gross domestic product (GDP) growth for Q1 of FY2020-21 (April-June 2020) was

-23.9 per cent. Statistically this is a remarkable contraction. The degree of decline in growth looks particularly stark given the positive growth of 3.1 per cent in Q4 of FY2019-20.

There were widespread expectations of the economy recording a sharp decline during Q1 of FY2020-21. The period April-June 2020 suffered the worst economic impact of COVID-19. The nation-wide lockdown imposed from 24 March 2020, one of the most stringent in the world, lasted several weeks, halting industrial production, enterprise and business functioning, mobility of people and goods, and social engagement. The gradual easing of restrictions from early June 2020 has enabled the slow resumption of economic activity in the country.

The deep decline in GDP growth rate during the quarter, therefore, was hardly surprising. The larger question is whether the later quarters will reflect a recovery in the growth rate, enabling the economy to turn around.

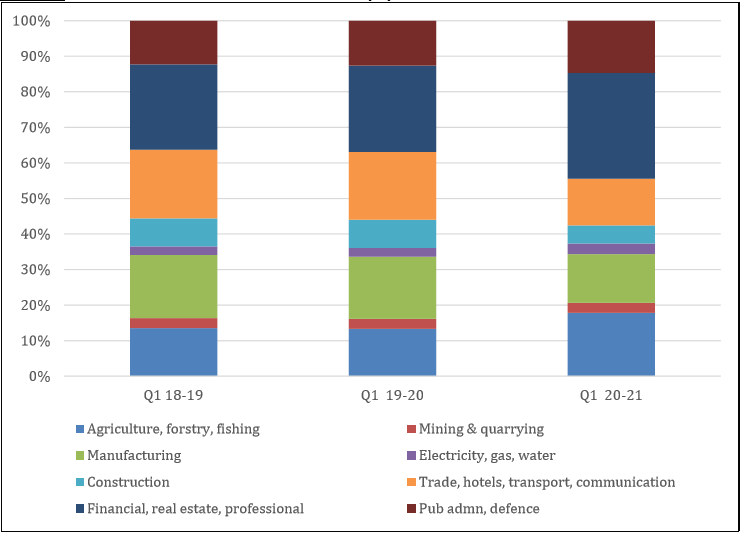

One of the principal concerns for the economy in returning to a positive rate of growth is the time to be taken for domestic service sectors to turn around. Services (trade, hotels, transport, communication and broadcasting); financial, real estate and professional services; public administration, defence and other services; and construction) comprise more than 60 per cent of India’s GDP (Figure 1). The contraction in these sectors has been severe.

Figure 1: Sector Share in Gross Value Added (%)

Source: Computed by Author from “Press Note on Estimates of GDP For The First Quarter (April-June) 2020-2”; National Statistical Office, Ministry of Statistics and Programme Implementation, Government of India; 31 August 202; http://mospi.nic.in/sites/default/files/press_release/PRESS_NOTE-Q1_2020-21.pdf

Trade, hotels, transport and communication grew by -47 per cent in Q1 of FY2020-21, followed by -5.3 per cent for financial, real estate and professional services, -10.3 per cent for public administration, defence and other services, and -50.3 per cent for construction. All these sectors, except construction, had recorded positive growth in Q4 of FY2019-20 (January-March 2020), when GDP grew by 3.1 per cent.

It is imperative for the services sectors to record a positive growth for the overall annual GDP growth to be positive. How soon might that be?

A closer look at the performance of some key industries reveals the specific areas contributing to the deep contraction in services. Foremost among these are the declines suffered by the railways and civil aviation during Q1 of FY2020-21. Passenger traffic by railways and passengers handled at airports reported -94.1 per cent and -99.5 per cent growth during the period. Cargo handled at airports, railways and seaports also declined significantly. Unless these operations revive, along with tourism and hospitality, the overall services sector growth would remain negative.

Given the current heavy incidences of COVID-19 in India, domestic passenger travel as well as movement of cargo across the country will take time to recover. The former remains restricted with various state governments regulating incoming flights and long-distance railway services yet to commence. The prolongation of COVID-19 will delay the lifting of travel restrictions as well. The impact will be considerable for aviation, railways and tourism, making the contraction in these sectors deeper and longer.

Construction is another key service sector impacting the overall GDP growth. A recovery in this sector is essential for creating short-term seasonal jobs for migrant labourers who have returned to their hometowns due to the lockdown. Its recovery is also essential for reviving the demand for steel and cement, which are vital manufacturing sectors capable of generating employment, and currently experiencing growth rates of -56.8 per cent and -38.3 per cent respectively. Construction growth would also recharge real estate and financial services as both consumption and investment demand will recover space for expansion.

What Lies Ahead

Looking ahead, the major domestic service sectors will take time to recover making prospects of overall services sector growth bleak for FY2020-21. Given the current state of COVID-19 in India, its GDP growth is unlikely to turn positive in FY2020-21. The remaining quarters of the year might see growth turning weakly positive, particularly during Q3 and Q4 as the lockdown retreats and more activities resume. FY2020-21 for India, much like the rest of the world, should mark a new low in its modern economic history.

. . . . .

Dr Amitendu Palit is a Senior Research Fellow and Research Lead (Trade and Economic Policy) at the Institute of South Asian Studies (ISAS), an autonomous research institute at the National University of Singapore (NUS). He can be contacted at isasap@nus.edu.sg. The author bears full responsibility for the facts cited and opinions expressed in this paper.

Photo credit: Wikimedia Commons

-

More From :

More From :

-

Tags :

Tags :

-

Download PDF

Download PDF