Sheikh Hasina’s Upcoming Visit to Tokyo:

Enhancing Bilateral Ties

Mohammad Masudur Rahman

24 November 2022Summary

Japanese multinationals are looking for alternative investment opportunities, either as a ‘China exit’ or a ‘China-plus’ strategy, and the Japanese government is supporting them to find suitable markets in this respect. On its part, Bangladesh has become an ideal place for investment due to its rapid socio-economic development and a growing middle class. The visit by Bangladesh’s Prime Minister to Japan on 29 and 30 November 2022 will provide the opportunity for both sides to enhance their relationship.

Robust Bilateral Relationship

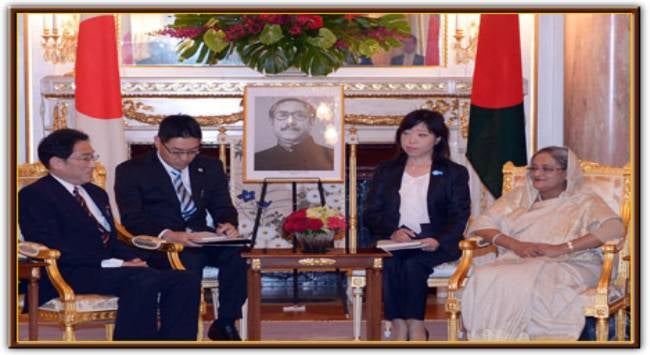

Bangladesh’s Prime Minister Sheikh Hasina will make her seventh state visit to Tokyo on 29 and 30 November 2022. Propelled by its growing role in trade and global supply chains, Bangladesh is now one of the fastest-growing emerging economies in the world and has made remarkable progress on its socio-economic front. Japan is a proponent of free trade and a rule-based global trading system. Over the past five decades, the two countries have shared a cordial relationship, and their ties have gradually grown stronger through cooperation in a number of areas.

Mega Investment in Power and Transport Sectors

The Japan International Cooperation Agency report (2022) stated that Tokyo supported the development of 2,343 megawatts of power generation capacity in 2021, which is about 10 per cent of the total power capacity of Bangladesh. Japan also supported the construction and rehabilitation of more than 25,000 kilometres of power distribution and 109 substations for power distribution. The report also mentioned that Japan contributed to the construction of 134 bridges, including six bridges over 500 metres in length: Jamuna, Paksey, Rupsha, Gumti, Meghna and Kalna. The construction of Jamuna Bridge has reduced crossing time from 36 hours to 15 minutes, including waiting time. Recently, Japan approved a loan of approximately US$1.2 billion (S$1.6 billion) to construct Matarbari deep seaport in the Araihazar Special Economic Zone (SEZ). Currently, three Mass Rapid Transit projects are under construction and are expected to carry two million passengers daily. Three Japanese firms – Marubeni Corporation, Kawasaki Heavy Industries, and Mitsubishi Corporation – are involved in constructing the metro rail in Dhaka, one of the country’s mega-projects.

There has also been a rise in investments from other private companies. According to the Bangladesh Investment Development Authority, about 338 Japanese companies are currently operating in Bangladesh and these have been growing yearly. Japan Tobacco International invested about US$1.47 billion (S$2 billion) in 2019 to buy Akij Tobacco, the biggest tobacco company in Bangladesh. The Japanese SEZ at Araihazar in Narayaganj is expected to commence operations by 2023, which will further boost Japanese investment in Bangladesh. Nippon Export and Investment Insurance recently provided loan insurance of US$177 million (US$240.7 million) to Reliance Bangladesh LNG and Power Ltd for a power plant project at Meghnaghat near Dhaka.

Official Development Assistance

Japan is one of Bangladesh’s most influential official development assistance partners – its contribution to Dhaka was about US$18 billion (S$25 billion) over the last five decades as of June 2021. Bangladesh’s external debt portfolio is dominated by World Bank loans which are 36 per cent of its total external debt and the second highest multi-lateral source of external borrowing is the Asian Development Bank. However, Japan is the top most bilateral source of external financing, which is 19 per cent of its total external borrowing while borrowing from China and Russia is only seven per cent of Bangladesh’s total external debt.

Bilateral Trade

Bangladesh-Japan bilateral trade was about US$3 billion (S$4.1 billion) in 2021, with Bangladesh’s exports to Japan amounting to about US$1.3 billion (S$1.8 billion). Japan is Bangladesh’s top export destination after the European Union and the United States. Bangladesh has been enjoying the Generalised System of Preferences scheme since the 1970s in its export to Japan. The main exports to Japan are garments and leather products, while Bangladesh imports primarily steel, vehicles, nuclear reactor and electronic products. However, the main export barriers to the Japanese market are the different types of non-tariff measures. An operational and effective economic partnership agreement with Japan may help ease these regulatory barriers and boost Japanese investment in Bangladesh.

Resilient Supply Chain

Dependency on the global supply chain is one of the critical issues that emerged during the COVID-19 pandemic. In 2020, Australia, India and Japan issued a joint statement on the Supply Chain Resilience Initiative and reaffirmed their determination to take the lead in delivering a free, fair and inclusive trade and investment environment in the Indo-Pacific. India is keen to link its pharmaceutical supply chain to Japan and Australia while Japan wants its car industry to boost its presence in India. Australia intends to reduce the risk of high dependency on Chinese products. Bangladesh has not been very successful in attracting foreign direct investment (FDI) – it has received net annual FDI inflow of about US$1.5 million (S$2.07 billion) in the last decade. Bangladesh must improve its investment and business climate through improved physical and soft infrastructure to attract more Japanese investment as well as integrate into the regional production network.

Operationalise the Economic Partnership Agreement

Although Bangladesh and Japan launched a comprehensive economic partnership arrangement (CEPA) in 2014, both sides need to finalise the operational modalities. Bangladesh needs to become proactive in the regional integration process, which may boost investors’ confidence. Dhaka should consider signing a functional CEPA or a preferential trade agreement with Tokyo to access the Japanese labour market and deal with non-tariff and other regulatory barriers and, in the process, ensure market access and a larger long-term bilateral collaboration.

. . . . .

Dr Mohammad Masudur Rahman is a Visiting Research Fellow at the Institute of South Asian Studies (ISAS), an autonomous research institute at the National University of Singapore (NUS). He can be contacted at masudrahman@nus.edu.sg. The author bears full responsibility for the facts cited and opinions expressed in this paper.

-

More From :

More From :

-

Tags :

Tags :

-

Download PDF

Download PDF